Data Center Industry Trends: Comparing 2022, 2023, 2024 State of the Data Center Reports

What are data center providers doing to deliver what customers want and technology enables? CoreSite, in partnership with Foundry, an IDC company, annually publishes State of the Data Center reports based on surveys conducted among several hundred IT executives as well as Foundry analysts’ industry research. These reports have identified and tracked digital business trends and the evolution of on-premises and third-party data centers, as well as public cloud services.

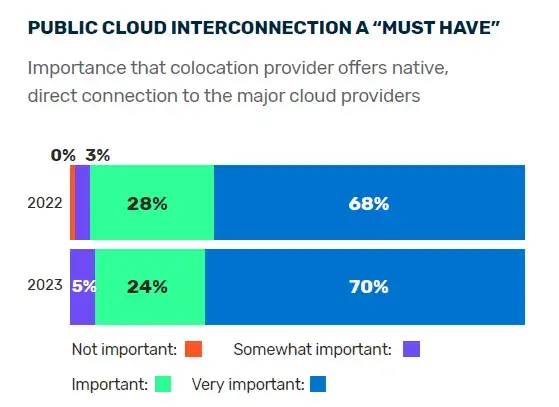

Before digging into the findings, we will single out a trend from the 2024 report as highly significant: Cloud interconnection was the No. 1 reason for using colocation for nearly half of the 22 workloads included in the survey. However, only 31% of the respondents said their current colocation provider offers interconnection to a variety of cloud providers.

Data center industry trends point to colocation being requisite for effective IT deployments. The business drivers this general observation is based on include:

- The proliferation of hybrid IT models among organizations in virtually every industry sector

- The need for redundant infrastructures that deliver greater reliability, physical security and data protection

- More demanding workloads that require higher performance and on-demand scalability

- Improved connectivity including robust interconnection capabilities that provide native access to public cloud onramps, edge computing sites and digital ecosystems of diverse IT service and solution providers

- The business imperative to slash costs inherent in building and operating on-premises data centers

- The flexibility to focus in-house IT staff on new, revenue generating activities rather than on data center operations.

This blog provides an easy-to-digest look at how these trends have evolved in light of changing business requirements and technology advances.

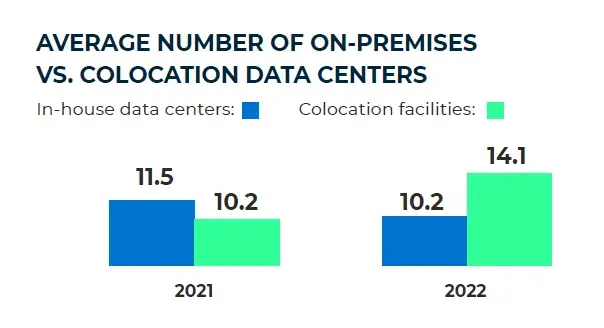

Why Enterprises are Moving to Colocation

Here are a few highlights of priorities that have influenced the migration from on-premises data centers to colocation data centers. If you read each report, you’ll notice that the survey does not cover precisely the same enterprise requirements each year. Priorities change, and analysts are inclined to survey relevant to “hot” topics. For example, you’ll see that in 2022 edge application performance was explored. Over the next two years, the significance of edge performance gave way to emerging requirements, notably improved connectivity to major cloud providers. You’ll see later in this post more details on annual survey findings, and more “apples-to-apples” trend comparisons.

| 2022 | 2023 | 2024 |

|

38% – Performance/speed, proximity to the edge |

94% – Improved connectivity; native direct connection to major cloud providers |

95% – Importance of native connections to major cloud providers |

| 37% – Reliability; guaranteed uptime |

29% – Accelerated revenue growth through digital transformation |

31% – Requirement that colocation provider offers multi-cloud and digital ecosystem interconnection |

|

33% – Physical security |

38% – Enhanced security and compliance |

Physical security a top-three colocation driver; survey did not rank based on percentage in 2024 |

|

28% – Scalability without increasing capital expenses |

8% – Scalability and flexibility of colocation |

Scalability is #2 of top 3 reasons to move from public cloud |

Trends for Workloads and the Role of Colocation

2022 Top Trend: Colocation plays an established and expansive role in IT modernization, serving as both a catalyst for innovation and as an interoperability hub

The 2022 State of the Data Center study found that:

- 94% were either currently using or planning to adopt a hybrid IT model within a year.

- A major shift of workloads from public clouds to colocation was occurring, including:

- 84% of content delivery/media processing applications

- 83% of collaboration and communications solutions

- 78% of business intelligence/data warehouse/data analytics initiatives

- At the same time, while some workloads were being shifted from the cloud to colocation, 96% of CIOs still expected colocation providers to provide native, direct connections to the major cloud service providers (versus 90% in 2021).

2023 Top Trend: Colocation emerges as the preferred option for interconnection and accelerating revenue growth

The 2023 study found that:

- 97% of respondents already had implemented or planned to implement a hybrid cloud model (up from 94% the previous year) and expected colocation data centers to provide robust interconnection with major cloud providers and digital ecosystem solution providers (cited in the 2024 report as the #1 reason to move to colocation).

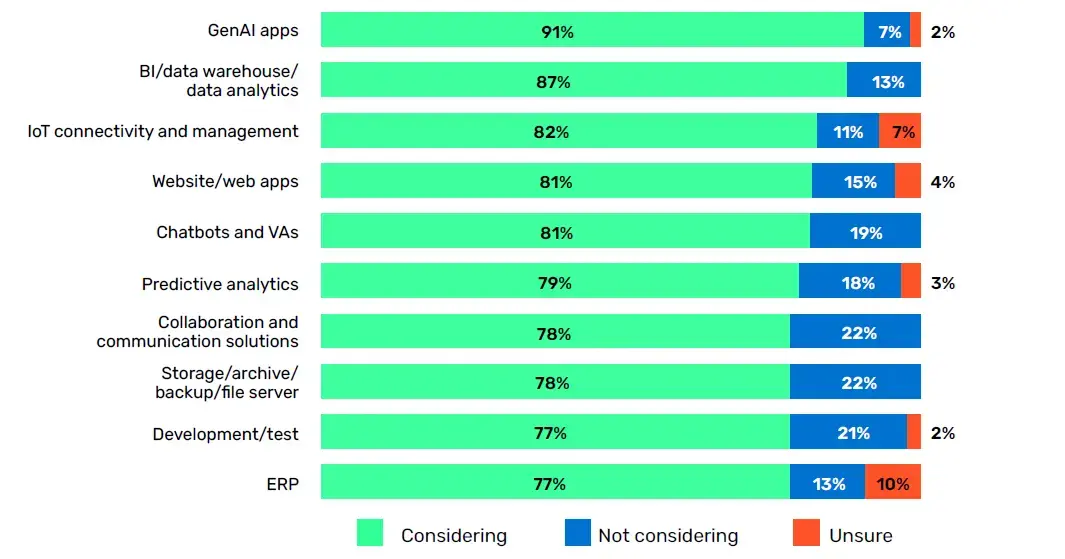

- Colocation housed a larger percentage of workloads than public cloud in all applications. Additionally:

- 92% of BI, data warehouse and data analytics workloads were under consideration to be moved from cloud to colocation (up from 78% in 2022)

- 92% of AI or machine learning applications were under consideration to be moved from cloud to colocation (up from 68% in 2022)

- 84% of Internet of Things connectivity and management (up from 69% in 2022)

- 81% of mobile apps were under consideration to be moved from cloud to colocation (up from 64% in 2022)

- 81% of storage/archive/backup/file server workloads were under consideration to be moved from cloud to colocation (up from 69%% in 2022)

- 80% of security/cybersecurity applications were under consideration to be moved from cloud to colocation (up from 70% in 2022)

In the words of a banking enterprise respondent…

“If it were up to me, everything would be in colocation! Our backup data center is a colocation facility. For organizations of our size, it really doesn’t make sense to own a data center. The capital requirements, the skill set requirements and multiple other reasons just make it a poor fit. We needed a disaster recovery site and the quickest way to get that was through colocation.”

(source: 2023 State of the Data Center Report)

2024 Top Trend: Cloud interconnection was the No. 1 reason for using colocation for nearly 50% of enterprise workloads. However, only 31% of the respondents said their current colocation provider offers interconnection to a variety of cloud providers.

We point out this finding because the 2024 Flexera State of the Cloud Report states: “89% of organizations embrace multi-cloud; of that, 73% use hybrid cloud, 14% use multiple public clouds and 2% use multiple private clouds.”

The Foundry 2024 study also found that:

- 60% of organizations were already employing a hybrid IT model (versus 55% and 58% in 2022 and 2023, respectively)

- An IT director for a retail company noted 30% of its IT infrastructure was hosted in colocation

- 42% of GenAI workloads were deployed in colocation versus on-premises or public cloud

- 75% of respondents are considering moving AI-related workloads from the cloud to colocation

Migration from On-Premises to Colocation Continues to Increase, Transforming Data Centers from Cost Centers to Value Drivers

Constant change in the data center industry is one of the few things you can confidently bet on. Another sure bet is that CoreSite will keep tracking the business drivers that compel continued evolution of hybrid IT strategies and respond with solutions aligned to customer requirements.

What are your digital business and IT modernization priorities? We would welcome the opportunity to learn about your organization and discuss how we could help meet your requirements today and tomorrow.

Please get in touch with us!